We advise our global clients, manage their capital, and offer multiple investment avenues for those seeking to invest in India.

DSP Global Funds ICAV (the “ICAV”), an open-ended umbrella-type Irish

DSP India will invest in a variety of investment strategies and instruments

Our co-investment strategy enables you to participate in our

DSP Pre-IPO Fund invests in private companies with proven

We believe that each of our managers should be given freedom and independence to manage his/her funds

“India is at the cusp of a structural turnaround and continues to remain one of the fastest-growing large economies in the world. The country has proven to be resilient to global economic downturns, largely due to its robust domestic economy, which is expected to remain strong in the foreseeable future. We believe India should be viewed as a structural allocation (and not just tactical) in investors’ portfolios globally.”

Jay Kothari

Lead Investment Strategist & Head - International Business

Interaction with 550+ companies, Industry expert and supply chain checks, daily morning calls, weekly all day team meeting- wednesday session, sell side interactions

In-depth research on business, management and financials and focus on drivers of profitability and RoE over long-term (including ESG)

Across each of the 350+ companies under coverage

Strategies to be predominantly in strong buys and buys

Strong Buy

Buy

Hold

Sell

Strong Sell

High conviction ideas

Temperament, research capability and eliminating behavioural baises

Capital misallocation, Long Term Business Disruption, Poor Governance and Adverse Regulatory Changes

A legacy built over

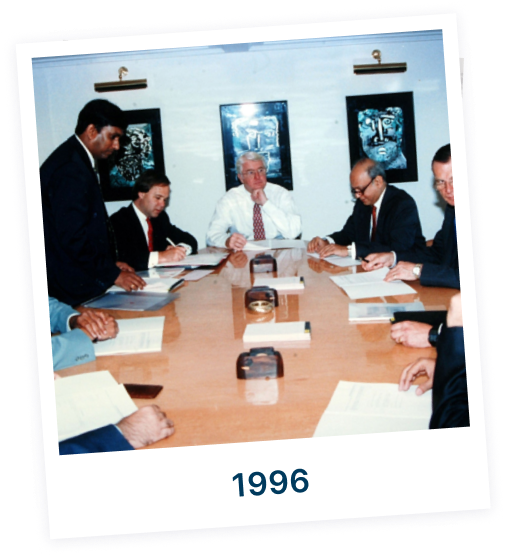

DSP Financial Consultants Limited (DSPFC) formed DSP Merrill Lynch Ltd. (DSPML), with Merrill Lynch initially acquiring a 29.41% equity stake, which was later increased to 40%.

This new Investment banking partnership was called DSP Merrill Lynch Asset Management (India) Ltd.

DSP Merrill Lynch Asset Management launched its first domestic equity and its first domestic debt mutual fund schemes.

DSP Merrill Lynch Fund Managers launched Merrill Lynch Specialist Investment Funds (MLSIF) India Fund, its first international fund meant for global investors looking to invest in India. This was a Luxembourg domiciled UCITS fund.

In line with BlackRock’s takeover of Merrill Lynch’s global asset management business in 2016, DSP Merrill Lynch Fund Managers became DSP BlackRock Investment Managers Ltd.

In May 2018, DSP Group announced its intention to purchase BlackRock's 40% stake in DSP Blackrock Investment Managers and in August 2018, the transaction was completed. The organisation was renamed to DSP Investment Managers, DSP BlackRock Mutual Fund became DSP Mutual Fund.

Demerger of asset management business from DSP Investment Managers Private Limited (“DSPIM”) to DSP Asset Managers Private Limited (“DSPAM”) has been effected from April 01, 2023. DSP Asset Managers continues resolutely on the path to help millions of Indians #InvestForGood, focusing on doing the right things with the right intent, always keeping investors' needs first.

160+

Years of Financial Legacy

$24B

Total Asset Under Management

27 years

In Asset Management Business

A collection of the latest reading resources and articles to build your knowledge

105 Unicorns, 3 Decacorns

and 7500+ listed companies

a golden period ensuring

demographic advantage till 2055

Average ~13B monthly UPI transactions in 2024

1 St Katharine’s Way, London, E1W 1UN, United Kingdom